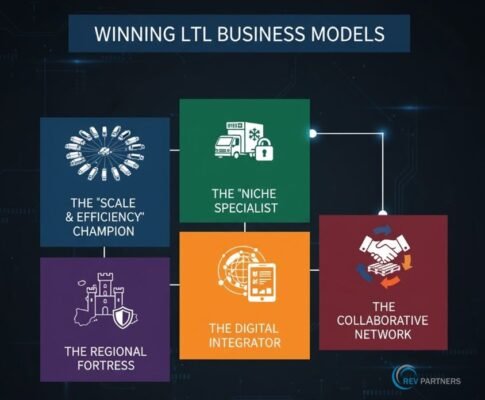

WINNING LTL BUSINESS MODELS

The European Less-Than-Truckload (LTL) market is at a strategic inflection point. For decades, success was often a function of scale and geographic reach. Today, the landscape is fundamentally fracturing. A convergence of powerful forces – relentless margin pressure, profound digital disruption, escalating sustainability (ESG) mandates, a structural driver shortage, and the fragmentation of demand driven by e-commerce – is rendering the “one-size-fits-all” model obsolete.

We are observing a “great fragmentation,” where value is no longer captured by the largest generalists but by focused, disciplined operators. In this new environment, strategic ambiguity is fatal. Winning now requires deliberate, clear-eyed choices. It demands selecting a specific strategic archetype and executing it with relentless, data-driven precision.

The most critical question for any LTL executive in Europe today is not “How can we be bigger?” but “What is our “way to win,” and how do we build an organization optimized exclusively for that model?”

My experience suggest that there are five distinct and winning business models. Choosing the right one – and having the courage to shed assets, capabilities, and customers that don’t fit – will separate the market leaders from the laggards in the decade to come.

THE ‘SCALE & EFFICIENCY’ CHAMPION

This is the classic, asset-heavy LTL model, refined for the digital age. It competes by leveraging a massive, dense, and proprietary hub-and-spoke network to achieve maximum operational efficiency and unmatched geographic coverage.

- Strategic Imperative: To be the indispensable, one-stop-shop network for large, sophisticated shippers requiring consistent, reliable, and pan-European service.

- Value Proposition: Unmatched geographic reach, high service consistency, and end-to-end reliability across Europe at a competitive, (but not the lowest) cost-per-shipment.

- Primary Profit Levers:

- Network Density: The lifeblood of the model. Every additional pallet on a route incrementally improves margin.

- Line-Haul Load Factors: Optimized through sophisticated yield management and freight flow planning.

- Hub Automation: High-throughput automated sorting hubs are no longer a “nice to have”; they are a core requirement to manage costs and ensure service quality at scale.

- Digital Integration: Deep IT integration with a core base of high-volume (e.g., CPG, Industrial) customers.

THE ‘NICHE SPECIALIST

This asset-heavy or “asset-right” model deliberately avoids direct competition with the Scale Champions. Instead, it focuses on high-margin, high-complexity verticals that require specialized assets, deep domain expertise, and regulatory certification.

- Strategic Imperative: To turn complexity, regulation, and risk into a powerful competitive moat.

- Value Proposition: Certified, compliant, and expert handling of specific, difficult-to-move products. Key niches include:

- Temperature-Controlled: Pharmaceuticals (GDP-certified) and high-value food (cold-chain).

- Hazardous Materials (Hazmat): Chemicals and industrial goods requiring ADR compliance and specialized handling protocols.

- High-Value / Fragile: Specialized handling, reduced touchpoints, and enhanced security for sensitive electronics, art, or machinery.

- Primary Profit Levers:

- Premium Pricing: Commensurate with the high value, high risk, and significant capital investment (e.g., reefer trailers, certified warehouses) required.

- Regulatory Barriers: The stringent certifications (GDP, ADR, TAPA) act as a powerful barrier to entry, limiting competition and protecting margins.

- Customer Stickiness: Deep integration into the customer’s quality-assurance and compliance systems creates extremely high switching costs.

THE DIGITAL INTEGRATOR

This is the asset-light, technology-centric platform model. This player owns the customer interface, the data, and the matching algorithms, but not the physical transportation assets. It aggregates demand from shippers (particularly SMEs) and matches it with fragmented capacity from thousands of small and medium-sized carriers.

- Strategic Imperative: To win the customer relationship through a superior, frictionless digital experience and to monetize information asymmetry.

- Value Proposition: Flexibility, transparent and competitive pricing (by aggregating shipper volume), and a seamless digital user experience (UX) for quoting, booking, and real-time tracking.

- Primary Profit Levers:

- Brokerage Margins: Capturing the spread between the price quoted to the shipper and the price paid to the carrier.

- Volume Aggregation: Using scale to negotiate favorable rates from carriers.

- Scalability: Extremely high scalability with low capital expenditure.

- The Asset-Light Paradox: This model is fundamentally symbiotic. While it scales rapidly, it is wholly dependent on the asset-heavy players for reliable capacity. As megatrends like driver shortages and green capex increase the value of physical assets, these aggregators must ensure they are indispensable partners to carriers, not just extractors of margin.

THE REGIONAL FORTRESS

This model is a direct response to the complexity of the European market. Instead of striving for pan-European coverage, the Regional Fortress builds an impenetrable leadership position in a specific, defined geography (e.g., Iberia, DACH, the Nordics).

- Strategic Imperative: To achieve unmatchable network density and customer intimacy within a limited geographic territory.

- Value Proposition: Superior service, faster transit times, and greater flexibility within their home region than any pan-European competitor can offer. They are the “hometown” expert.

- Primary Profit Levers:

- Extreme Network Density: By focusing all assets in one region, they can achieve line-haul and P&D efficiencies that competitors cannot match.

- Local Customer Intimacy: Deep-rooted, multi-decade relationships with the regional industrial and commercial base.

- Brand Dominance: They are the default, trusted provider in their market, which affords them a degree of pricing power and loyalty.

- Operational Simplicity: Avoids the cross-border and regulatory complexity that burdens pan-European players.

THE COLLABORATIVE NETWORK

This is a uniquely European, hybrid cooperative or franchise model. A central entity operates the main hub(s), the brand, and the core IT platform. It partners with dozens or hundreds of independent, regional hauliers (“members”) who act as the “spokes” for first and last-mile operations in their exclusive territories.

- Strategic Imperative: To combine the local expertise and entrepreneurial agility of an SME with the national or pan-European reach of a large incumbent.

- Value Proposition: A powerful “best of both worlds” offering: the scale and IT of a major network, delivered with the local customer service and relationship focus of a regional, family-owned business.

- Primary Profit Levers:

- Low Central Overhead: The model “variabilizes” the most significant cost – P&D – by outsourcing it to members.

- High Scalability: A new region or country can be “switched on” by signing up new members, requiring minimal central capital investment.

- Aligned Incentives: The “member-owner” model fosters a powerful, aligned culture of service quality and cost control, as members’ profitability is directly tied to the network’s collective success.

THE MANDATE FOR STRATEGIC CLARITY

The European LTL market will no longer subsidize a lack of focus. The winners of the next decade will not be those who try to be everything to everyone, but those who choose their battlefield. They will be the Pan-European Scale Champions with automated hubs, the Vertical Specialists whose regulatory moats are impenetrable, the Digital Aggregators who own the customer interface, the Collaborative Networks built on local agility, the Regional Fortresses who are unbeatable on their home turf, and the Heavy & Bulky Specialists who master the e-commerce final mile.

This new reality requires executives to ask a series of uncomfortable, high-stakes questions: Which of these five models truly represents our “way to win”? Which capabilities do we need to build, acquire, or partner for to execute it? And, most painfully, which customers, assets, and business lines must we have the courage to divest because they no longer fit?

The time for incrementalism is over. The mandate is for bold, decisive, and strategic transformation.

——————————————————————————————————————————-

ABOUT REV PARTNERS

REV Partners. Business Transformation Experts. Digital Transformation Experts. We are a Management Consulting & Advisory firm. We help Fortune 500 & Private Equity clients address the most pressing issues related to Transformation, Strategy, Operations, Organization and Digital. We can also provide experienced experts as Interim “Chief Transformation Officer” or equivalent, to accelerate, lead and execute ambitious Business Transformation or Digital Transformation programs. If you or your organization need support, please contact us, follow us on Twitter or Email us at: meet@revpartners.com.

© REV Partners. All Rights Reserved.