What is Portfolio Transformation?

Portfolio transformation refers to the process of reshaping an organization’s portfolio of businesses, products, and services to align with its strategic goals and adapt to changing market conditions. This process typically involves a review of the current portfolio, the identification of areas for improvement, and the implementation of changes to improve performance and drive growth. This can include divesting underperforming businesses, investing in new growth opportunities, and realigning resources to optimize the portfolio.

See Also: Complete Guide to Digital Transformation

See Also: Cases in Transformation: Portfolio Transformation at Evonik

See Also: Lessons In Business Transformation: DSM

What is Driving the Need for Portfolio Transformation

The need for portfolio transformation in organizations is driven by a variety of factors, including:

Industry disruption

Rapid technological advancement and the emergence of new business models are disrupting traditional industries. Organizations must transform their portfolios to stay competitive and adapt to these changes. For example, the rise of e-commerce and digital platforms have disrupted traditional brick and mortar retail businesses, forcing them to reconsider their portfolio and shift towards a more digital presence. Similarly, the emergence of new technologies such as artificial intelligence and blockchain are disrupting various industries and forcing organizations to invest in these areas to stay competitive.

Shifting consumer preferences

The changing preferences of consumers are driving the need for organizations to transform their portfolios to better meet the needs of customers. This includes changes in consumer behavior, preferences for different products and services, and the increasing importance of sustainability and corporate social responsibility. For example, the increasing demand for organic and healthy food options is driving food manufacturers to invest in organic and natural products, while the growing concern for the environment is driving companies to invest in more sustainable products and packaging.

Increased competition

The globalized economy and increased competition are putting pressure on organizations to optimize their portfolios to stay competitive. Organizations must continuously assess their competitiveness and adapt to the changing market conditions to maintain a competitive edge. This includes identifying new growth opportunities, divesting underperforming businesses, and investing in new technologies and innovations.

Mergers and acquisitions

Organizations may also need to transform their portfolios as a result of mergers and acquisitions to optimize the combined portfolio. This includes identifying and divesting underperforming businesses, products, and services, and realigning resources to optimize the combined portfolio.

Digitalization

The digitization of business processes and the emergence of new technologies are also driving the need for organizations to transform their portfolios to stay competitive in the digital age. This includes investing in digital technologies, such as cloud computing, big data analytics, and artificial intelligence, to drive growth and innovation.

Regulatory changes

Changes in regulations and policies can impact an organization’s portfolio and drive the need for change. For example, changes in environmental regulations may force organizations to invest in more sustainable products and production methods, while changes in labor laws may impact the cost and availability of personnel.

Economic conditions

Economic conditions such as recession or inflation can also drive the need for organizations to transform their portfolios to adapt to changing market conditions. During economic downturns, organizations may need to divest underperforming businesses, products, and services, and focus on cost reduction to maintain profitability.

Environmental, social and governance (ESG) concerns

The growing focus on ESG concerns is also driving the need for organizations to transform their portfolios to align with these priorities. This includes investing in more sustainable businesses, products, and services, and divesting from those that do not align with ESG priorities. Additionally, it includes incorporating sustainable practices in operations, such as reducing carbon footprint, implementing fair labor practices, and promoting diversity and inclusion.

Geopolitical changes

Organizations also need to consider how geopolitical changes can impact their portfolio. For example, trade tariffs and tariffs can impact the cost and availability of goods and raw materials, while changes in political and economic conditions in a particular region can affect the risk and return of investments.

Organizational structure: Organizational structure can also drive the need for portfolio transformation. For example, a decentralized organization with multiple business units may need to optimize its portfolio to streamline operations and increase efficiency.

Key Steps for Portfolio Transformation

Partial list of process steps for Portfolio Transformation include:

Portfolio review

The first step in portfolio transformation is to conduct a thorough review of the current portfolio. This includes assessing the performance of each business, product, and service, identifying areas of strengths and weaknesses, and determining which assets are critical to the organization’s success. This review should include an analysis of financial performance, market position, competitive landscape, and customer demand. It is important to gather input and feedback from different stakeholders, including business leaders, customers, and employees, to gain a comprehensive understanding of the current portfolio.

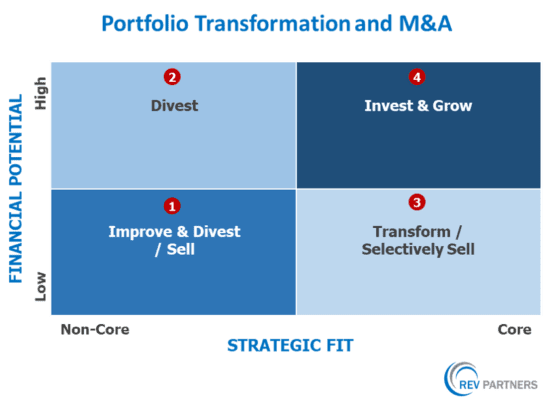

Exhibit 1

A preliminary assessment could lead to several portfolio decisions, including:

- Invest & grow

- Exit or Divest

- Transform and then exit

Strategic alignment

After the portfolio review, the next step is to align the portfolio with the organization’s strategic goals and objectives. This includes identifying which businesses, products, and services are aligned with the organization’s mission and vision, and which are not. It also includes identifying growth opportunities and areas for investment that align with the organization’s strategic goals. The outcome of this step should be a clear understanding of the portfolio’s strategic fit and a roadmap for aligning it with the organization’s goals. This step should also include an assessment of the organization’s capabilities and assets and how they can be leveraged to drive growth and innovation.

Divestment and investment

As a result of the portfolio review and strategic alignment, organizations may decide to divest underperforming businesses, products, and services, and invest in new growth opportunities. This can include acquiring complementary businesses, products, and services, or investing in new technologies and innovations. This step should also include a detailed financial analysis of potential investments and divestitures, and a clear rationale for why these changes are necessary for the organization.

Implementation and execution

After the portfolio changes are determined, the next step is to implement and execute the changes. This includes developing a detailed plan for each change and ensuring that all stakeholders are informed and engaged in the process. This step should also include a detailed project plan for each initiative, with clear timelines, milestones, and responsibilities for each team member.

Continuous monitoring and review: Portfolio transformation is not a one-time process, but rather a continuous effort. Organizations should regularly review and monitor their portfolio to ensure that it remains aligned with their strategic goals and adapts to changing market conditions. This includes monitoring the performance of the portfolio, assessing the impact of changes, and identifying new growth opportunities. Regular monitoring enables organizations to identify any issues or obstacles that may arise during the execution of the portfolio changes and take timely corrective actions.

Portfolio Governance

A strong governance structure should be put in place to ensure that the portfolio transformation process is executed effectively and efficiently. This includes setting up a dedicated transformation team, with clear roles and responsibilities, as well as regular reporting and monitoring of progress. It also includes ensuring that the transformation is aligned with the organization’s overall strategy and that the process is transparent and accountable to all stakeholders.

Change management

A key component of the implementation and execution step is change management. This includes managing the people-side of the transformation, including communication, training, and engagement of employees, as well as managing the cultural and organizational aspects of the change.

Portfolio measurement and tracking

Performance measurement and tracking is critical to ensure that the portfolio transformation is delivering the desired results. This includes setting clear performance metrics and targets, and tracking progress against them. This helps the organization to identify areas that need improvement and make adjustments as needed.

Some examples of Portfolio Transformation

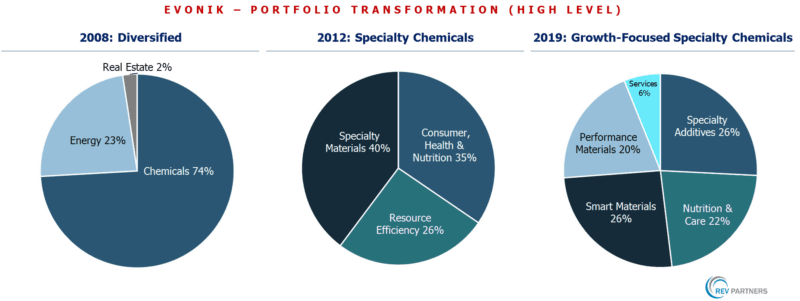

01. Evonik Portfolio Transformation

Read more on Evonik’s Portfolio Transformation: Cases in Transformation: Portfolio Transformation at Evonik

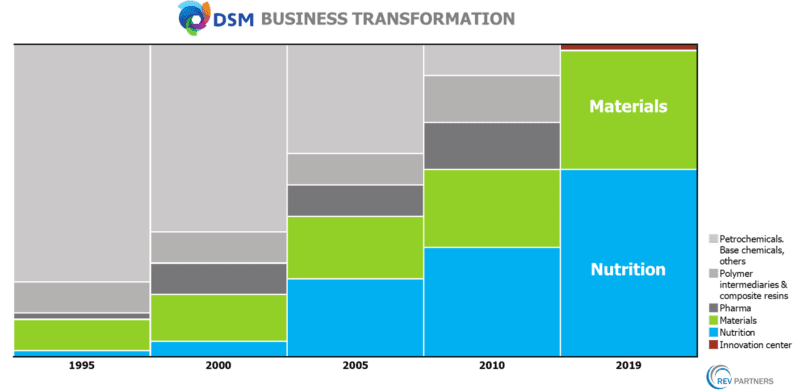

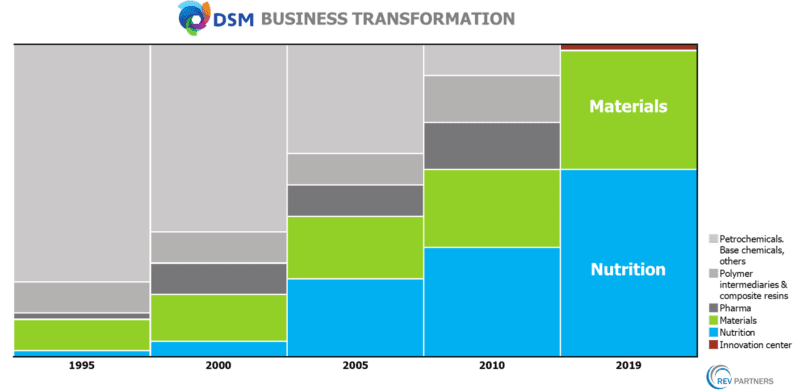

02. DSM Portfolio Transformation

Read more on DSM Portfolio Transformation: Lessons In Business Transformation: DSM

Portfolio transformation is a long-term, and often complex process. It includes a thorough review of the current portfolio, aligning it with the organization’s strategic goals, followed by iterative optimization & executions. The key to a successful portfolio transformation is to ensure that the process is data-driven, well-planned, and executed well.

——————————————————————————————————————————-

REV Partners. Business Transformation Experts. Digital Transformation Experts. We are a Management Consulting & Advisory firm. We help Fortune 500 & Private Equity clients address the most pressing issues related to Transformation, Strategy, Operations, Organization and Digital. We can also provide experienced experts as Interim “Chief Transformation Officer” or equivalent, to accelerate, lead and execute ambitious Business Transformation or Digital Transformation programs. If you or your organization need support, please contact us, follow us on Twitter, or Email us at: meet@revpartners.com. © REV Partners. All Rights Reserved.