Levers of Value Creation in FTL Market

For decades, the European Full Truckload (FTL) market has been viewed as a low-margin, highly fragmented “blood-bath” – a commoditized game of managing assets and fuel. This perspective is now dangerously obsolete. We are in the midst of a profound structural shift, a “great reconfiguration” driven by the twin disruptions of digitization and decarbonization. The very definition of value is being rewritten.

Profitability is no longer a simple function of cost-per-mile. The old-world “haulier” who simply moves a box from A to B is being systematically squeezed into irrelevance. The new winners – the “Big 3” business models of asset-heavy champions, digital-native platforms, and high-value specialists – are not just competing. They are actively reshaping the market by mastering a new set of fundamentals.

They understand that the underlying truck is becoming a data-tracked, zero-emission commodity. The real value has migrated from the asset itself to the network, the data, the service integration, and the management of strategic risk. The successful competitive strategies we observe today are simply different configurations aimed at maximizing four primary drivers of value.

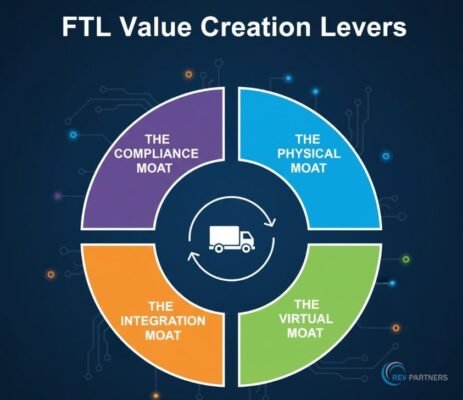

My experience suggests that these 4 moats will drive offensive and defensive strategies in the near term:

THE PHYSICAL MOAT – ASSET UTILIZATION AND NETWORK DENSITY

In the asset-heavy playbook, the entire battle is against the “deadhead,” or empty, mile. An empty truck is not just a missed opportunity; it is a significant cash burn, costing upwards of €1.20/km. Profitability is therefore driven by one core KPI: Asset Utilization.

Value is created by building a network so dense that it ensures constant, reliable backhauls. This is not just about owning trucks; it is about owning a network that creates internal loops and guarantees loads, thereby lowering the average cost-per-loaded-mile. This is, in effect, the LTL network advantage applied to the FTL market.

This density provides two crucial advantages:

- A Cost Advantage: A higher utilization rate directly translates to superior operational leverage and margin, a defense that fragmented, small-scale carriers cannot breach.

- A Service Guarantee: This scale provides the capacity and reliability that blue-chip shippers demand, forming the foundation of long-term, high-volume contracts.

For leaders in this space, the strategic imperative is clear: investment must be focused on building regional or pan-European density that creates an unassailable physical moat.

THE VIRTUAL MOAT – CARRIER NETWORK SCALE AND DATA ANALYTICS

In the asset-light and digital-native models, the paradigm is inverted. Profitability is driven not by ownership of assets, but by access to capacity and the speed of the match.

The core asset for these platforms is not steel, but data and algorithms. By aggregating the “long tail” of fragmented carriers, digital platforms create a “virtual fleet” that can exceed thousands of trucks. This scale, matched with sophisticated AI, offers shippers a single-source solution while optimizing the “pooled” capacity of the entire network, reducing empty miles for carriers who would otherwise struggle to find backhauls.

In this model, the data analytics itself becomes the value proposition. The platform becomes an “operating system” for the FTL ecosystem, creating a virtuous cycle: more shippers attract more carriers, which provides more data, which in turn improves the matching algorithm and network efficiency, solidifying the platform’s advantage. The strategic question for leaders is no longer “How many trucks do we own?” but “How much of the market’s capacity can we orchestrate?”

THE INTEGRATION MOAT – FROM HAULIER TO EMBEDDED LOGISTICS PARTNER

As the underlying asset becomes commoditized, sustainable value migrates to the high-margin services around the asset. This is the critical shift from being a “haulier” to becoming a “logistics partner.”

Value is created by deeply embedding operations within the customer’s value chain, creating high switching costs. This is achieved through:

- High-Value Specialization: Providing high-margin, high-reliability transport for complex verticals like cold-chain (pharma, food), verified by real-time IoT sensors.

- Deep Data Integration: Moving beyond simple track-and-trace portals. The value lies in providing real-time visibility data not on a website, but directly into the shipper’s ERP or TMS via API. The carrier becomes an integral part of the customer’s core operating system.

- Sustainability as a Service: Providing automated, auditable, and reliable emissions data per-shipment. This saves the shipper significant compliance costs and administrative burdens, transforming a reporting requirement into a value-added service.

The strategic imperative here is to stop selling truck capacity and start selling auditable data, operational integration, and commercial peace of mind.

THE COMPLIANCE MOAT – PROACTIVE REGULATORY AND ESG MANAGEMENT

This is perhaps the newest and most under-appreciated value driver. For decades, compliance was a cost center to be minimized. In the new FTL paradigm, it has become a powerful competitive weapon.

The EU Mobility Package and the accelerating ZEV / Euro 7 transition are not just regulatory hurdles; they are a market filter. These mandates are systematically raising the bar for capital investment, operational complexity, and reporting. Carriers who cannot master this new reality will be filtered out.

Proactive management is the new frontier of differentiation. Carriers who can fund and execute a credible transition to ZEVs, or who can expertly manage the complexities of driver regulations, are no longer just hauliers. They are “de-risking” their customers’ supply chains.

For blue-chip shippers with their own non-negotiable ESG goals, a carrier’s compliance and sustainability posture is now a prerequisite for winning 3-to-5-year contracts. These proactive carriers can command a premium for the certainty and compliance they provide, effectively monetizing their regulatory mastery.

THE GREAT RECONFIGURATION

These four levers – physical density, virtual network scale, deep integration, and compliance mastery – are the new physics of the FTL industry. They are not a checklist to be delegated, but the core pillars of strategy.

The market is rapidly bifurcating. On one side will be the “haves”: a consolidated group of asset-heavy champions, tech-driven orchestrators, and high-value specialists who have mastered these levers. On the other will be the “have-nots”: the fragmented, undifferentiated commodity hauliers who will be squeezed by rising costs, compliance burdens, and platform pricing power.

The ultimate strategic question for every FTL executive is no longer “How do we run our trucks more efficiently?” but “Which combination of these value levers will we master to build a defensible, profitable and sustainable enterprise?”

The transition is already underway. The time to define that strategy is now.

Navigating this new paradigm requires a clear-eyed assessment of your current position and a bold strategy for the future. If your organization is ready to move beyond the mile and build a durable competitive advantage, get in touch. We can help you chart the course.

——————————————————————————————————————————-

ABOUT REV PARTNERS

REV Partners. Business Transformation Experts. Digital Transformation Experts. We are a Management Consulting & Advisory firm. We help Fortune 500 & Private Equity clients address the most pressing issues related to Transformation, Strategy, Operations, Organization and Digital. We can also provide experienced experts as Interim “Chief Transformation Officer” or equivalent, to accelerate, lead and execute ambitious Business Transformation or Digital Transformation programs. If you or your organization need support, please contact us, follow us on Twitter or Email us at: meet@revpartners.com.

© REV Partners. All Rights Reserved.