Winning in the European Lightside Building Materials Market

The European Lightside Building Materials market is driven by strong underlying growth in construction activity. However, our analysis reveals that majority of manufacturers in the building materials sector are failing to generate meaningful economic value. This paradox is a symptom of a fundamental value migration, where traditional business models are no longer fit for purpose.

Four powerful megatrends are simultaneously reshaping the Lightside battlefield:

- Sustainability: The industry’s primary driver (renovation) is creating its primary threat (a surge in embodied carbon), forcing a shift to low-carbon materials and circularity

- Digitalization of the Value Chain: Building Information Modeling (BIM) and B2B e-commerce are converging, moving the point of sale from a “relationship” to a “digital specification”.

- Industrialized Construction: A structural skilled labor deficit of over 2 million workers is rendering traditional construction methods non-viable. This is forcing the market toward off-site, modular “manufacturing-style production”.

- M&A and Investment: Private equity and venture capital are validating these trends, with deal share doubling and M&A activity laser-focused on acquiring capabilities in sustainability, technology, and modular construction

Market profit pool data suggests that value is migrating. It is shifting away from the manufacture and sale of discrete, commoditized components and toward, for example. the players who can win the digital specification of integrated, low-carbon systems.

Key Winning Business Models

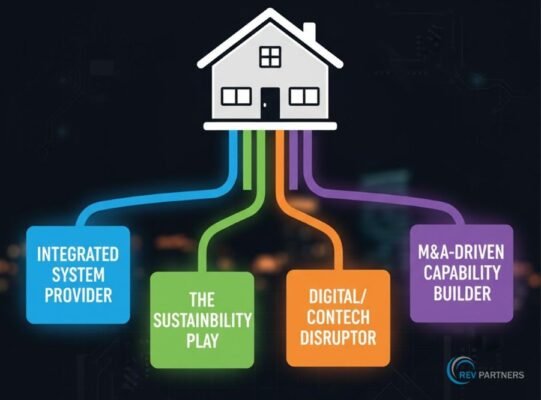

The new strategic framework is already being executed in the market. My experience suggests that there are four distinct winning business models are emerging, each designed to capture value from one or more of the megatrends.

Model 1: The Integrated System Provider (e.g., Saint-Gobain)

- Strategy: To bundle discrete lightside products (plasterboard, insulation, sealants, accessories) into a single, certified, high-performance system, thereby increasing cross-selling, simplifying installation, and creating a powerful specification “moat.”

- Evidence: These market leaders no longer just sell products; they sell “solutions.” Saint-Gobain provides “a comprehensive suite of gypsum-based building products… for a complete installation system.” Knauf provides “drywall systems.” Sika’s case studies show them selling “a complete Sika solution“or “Sikafloor DecoDur Systems”, not just a single product.

- How to win: This model executes simple “solution-selling” to the specifier and the contractor. Instead of an architect specifying 10 different products from 10 companies and hoping they meet the fire code, they can specify one “Saint-Gobain Fire-Rated Wall System” from a BIM library. This simplifies the architect’s job, guarantees performance for the contractor, and—most importantly—locks out all component-level competitors from the sale.

Model 2: The Sustainability Play (e.g., Kingspan)

- Strategy: To lead, aggressively and publicly, on sustainability and decarbonization, transforming it from a cost center into a core product attribute and competitive weapon.

- Evidence: Kingspan’s “Planet Passionate” program is a master class in this. They are not just reporting emissions; they are innovating their product line with “LEC (Lower Embodied Carbon) products” and “bio-based insulation solutions”. They have set aggressive, binding, science-based targets for reducing absolute emissions across Scopes 1, 2, and 3.

- How to win: This model directly solves the “Two-Front Carbon War.” Kingspan provides a solution for the Embodied Carbon problem, not just the Operational Carbon one. This allows them to “win the specification” with the architects, investors, and “green building” councils who are now mandated to report on whole-life carbon. They are building a “green moat” around their business that competitors with high-embodied-carbon products cannot cross.

Model 3: The Digital (ConTech) Disruptor

- Strategy: To remain “asset-light” and use software to attack a single, high-friction, high-value point in the value chain (either Specification or Procurement).

- Evidence: “Vizcab,” a French startup that “provides a platform for calculating the carbon lifecycle.” This directly attacks the “Specification” stage by providing the critical Embodied Carbon data that architects now need and incumbents are slow to provide. “ROOBEO,” a Berlin startup building an “online marketplace” to “bring the full range of 15 professional trades onto one platform,” directly attacking the fragmented, analog distribution pool.

- How to win: They “unbundle” the value chain through Digitalization. They are not trying to manufacture or sell insulation. They are capturing value by becoming the digital interface for either specifying (Vizcab) or procuring (ROOBEO) the insulation, squeezing the incumbent manufacturers in the middle.

Model 4: The M&A-Driven Capability Builder (e.g., PE-led Platforms)

- Strategy: To use M&A as a “fast-follower” strategy, bypassing the slow R&D of incumbents and acquiring the capabilities of the other three models. This is combined with a “buy-and-build” consolidation.

- Evidence: This model executes on the M&A thesis from (M&A for capability). PE deal share in the sector has doubled. The 2021 acquisition by Partners Group is the perfect case study. This PE firm did not just buy a generic “building materials” company; they bought Parmaco, a “leading provider of… modular education buildings.”

- How they win: Speed and Focus. They are buying directly into a Megatrend (Industrialized Construction). Instead of an incumbent manufacturer spending five years and millions in R&D trying to build a new modular division, the PE firm buys an existing platform (Parmaco) and “bolts on” acquisitions, scaling a new business model faster than incumbents can pivot their old one.

The assessments suggest that the market’s value levers have shifted. A “business as usual” approach will relegate the company to the back of the line. To move into the top 20% and capture the asymmetric returns, Boards must sanction a clear and decisive transformation.

——————————————————————————————————————————-

ABOUT REV PARTNERS

REV Partners. Business Transformation Experts. Digital Transformation Experts. We are a Management Consulting & Advisory firm. We help Fortune 500 & Private Equity clients address the most pressing issues related to Transformation, Strategy, Operations, Organization and Digital. We can also provide experienced experts as Interim “Chief Transformation Officer” or equivalent, to accelerate, lead and execute ambitious Business Transformation or Digital Transformation programs. If you or your organization need support, please contact us, follow us on Twitter or Email us at: meet@revpartners.com.

© REV Partners. All Rights Reserved.