Leveraging Aftermarket Sales and Service in Industrials

The Importance of Aftermarket Sales and Service for Manufacturers: Manufacturers of durable goods have been steadily capitalizing on aftermarket sales and service to generate revenue. This applies to not only B2C business es like automotive manufacturers, but also B2B entities in the industrial machinery and automation sectors, as well as B2G businesses operating in aerospace and defense.

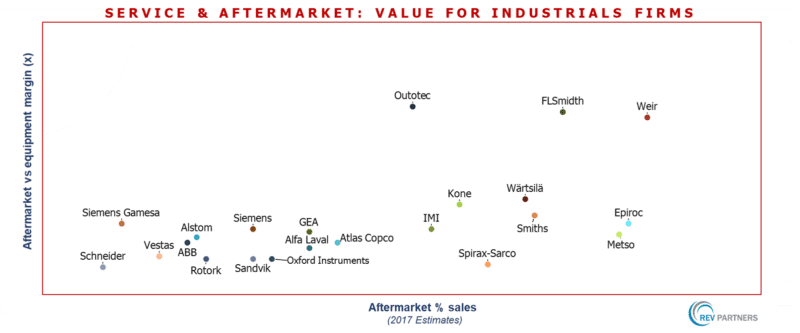

As you can see in Exhibit 1, below, what was once a mere supplementary business focused on selling spare parts has now evolved into a significant value creator for many manufacturers.

Exhibit 1: Value of Aftermarket & Service Revenues for Industrials Firms

Developing a strong aftermarket presence has three key advantages. First and foremost, it enhances the end-user experience. By offering maintenance and replacement parts, manufacturers can ensure longer product life and improved performance. It stands to reason that the OEM that designed the product will be the most knowledgeable about its maintenance.

Secondly, aftermarket sales and service allow manufacturers to maintain close customer relationships. Regular interactions during the product’s life cycle offer the opportunity to understand ongoing customer needs and influence their decisions.

Lastly, shareholders benefit from increased operational cash flows and reduced risk through aftermarket offerings. Margins on aftermarket services often double or even reach ten times higher than margins on new unit sales. In some cases, aftermarket revenue is contractually guaranteed, providing stable and predictable cash flows.

However, potential pitfalls also exist. Before venturing into aftermarket services, companies must consider how these offerings align with their overall strategy. Failing to address this issue can result in a suboptimal return on investment.

Aftermarket sales and service can be a significant driver of profitability and value creation for manufacturers of durable goods. To reap the full benefits of these offerings, companies must thoughtfully integrate aftermarket services into their product development, sales, and execution processes. By doing so, they can successfully capitalize on the tremendous opportunities that aftermarket sales and service present, leading to long-term growth and competitive advantage.

The Strategic Significance of Aftermarket Sales and Services

Aftermarket parts and services have become essential drivers of success for durable-goods manufacturers. In many cases, they offer the most significant economic returns and value creation. An effective aftermarket strategy can bolster operational cash flows, minimize risk, and enhance customer experiences. However, each company must carefully assess the optimal approach, considering factors like market dynamics, competition, customer intimacy, and integration of aftermarket offerings into core business processes. Companies must be aware that their choices surrounding aftermarket strategies can profoundly impact their overall strategic direction.

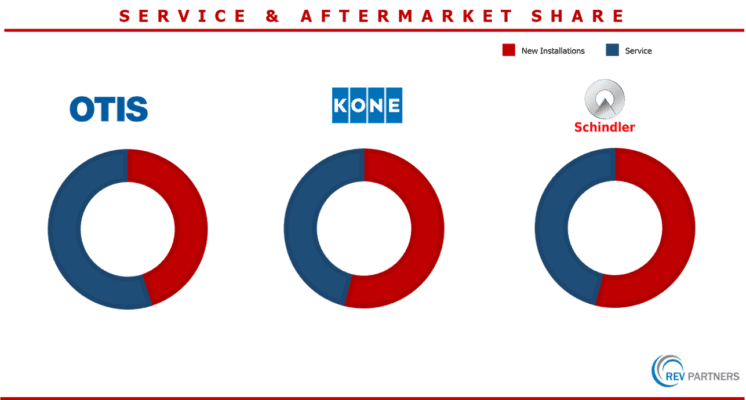

Exhibit 2: Hight Share of Aftermarket & Service Revenues for Elevator OEMs

Exhibit 2: Hight Share of Aftermarket & Service Revenues for Elevator OEMs

Key Strategic Moves to Leverage Aftermarket Sales and Service

Architect an Integrated, Data-Driven Service Ecosystem

The foundation of modern aftermarket success is a holistic, digital architecture that connects the installed base, service operations, and the customer. This moves beyond disparate legacy systems to a unified platform that provides end-to-end visibility.

-

Real-time Asset Monitoring: Leveraging Industrial IoT (IIoT) to capture real-time data from deployed equipment. This enables a shift from reactive repairs to predictive and even prescriptive maintenance, preventing failures before they occur and optimizing asset uptime.

-

Integrated Field Service Management (FSM): Deploying advanced FSM platforms that optimize technician scheduling, dispatch, parts availability, and route planning. This not only enhances efficiency but also ensures technicians arrive with the right parts and knowledge, improving first-time fix rates and customer satisfaction.

-

Customer Portals and Digital Self-Service: Empowering customers with intuitive digital platforms for ordering parts, requesting service, tracking progress, and accessing technical documentation. This reduces inbound call volumes, improves response times, and enhances the overall customer experience.

Shift to Outcome-Based and “As-a-Service” Business Models

The most significant strategic pivot in the aftermarket is the transition from selling products and hours to selling performance and outcomes. This is the essence of servitization.

-

Performance Guarantees: Offering contracts that tie compensation to actual equipment uptime, throughput, or energy efficiency, rather than just service visits. This aligns incentives directly with customer value.

-

Equipment-as-a-Service (EaaS): Providing customers with access to equipment functionality, paying a subscription fee based on usage or output, rather than purchasing the asset outright. This lowers customer capital expenditure, creates predictable revenue streams for the provider, and necessitates a deep commitment to maximizing asset performance.

-

Managed Services: Taking on broader operational responsibilities for specific customer processes or infrastructure, extending beyond basic maintenance to full operational management.

Optimize the Global Spare Parts and Supply Chain

Effective spare parts management is the lifeblood of aftermarket profitability, yet it remains a significant challenge for many. Leading companies are applying advanced analytics and digital tools to transform this area.

-

Predictive Inventory Management: Utilizing machine learning to forecast parts demand based on equipment usage, failure patterns, and geographic installed base. This minimizes inventory holding costs while maximizing parts availability.

-

Dynamic Pricing Strategies: Implementing sophisticated pricing models that factor in urgency, customer segment, part criticality, and competitive dynamics. This moves beyond static price lists to optimize revenue and margin.

-

Circular Economy Principles: Integrating remanufacturing, refurbishment, and reuse programs for critical components. This not only offers more sustainable options but also creates alternative, often higher-margin, revenue streams and strengthens supply chain resilience against raw material volatility.

Cultivate a Value-Driven Service Culture and Talent Base

Technology and processes are only as effective as the people who execute them. Transforming aftermarket operations requires a parallel transformation of talent and culture.

-

Upskilling the Field Force: Investing in continuous training for technicians, focusing on digital tools, remote diagnostics, problem-solving, and customer-facing soft skills. The technician is often the primary face of the company to the customer.

-

Sales Enablement for Service Teams: Empowering field technicians and service managers to identify cross-sell and up-sell opportunities, leveraging their deep understanding of the customer’s operational needs.

-

Customer Success Teams: Establishing dedicated teams focused on proactively ensuring customers maximize value from their installed equipment and service contracts. This fosters loyalty and identifies new opportunities for collaboration.

Leverage Aftermarket for Strategic Intelligence and Product Development

The aftermarket is a treasure trove of operational data and customer insights, often underutilized for broader strategic purposes.

-

Voice of the Customer (VoC): Systematically capturing feedback from service interactions, repair histories, and customer portals to directly inform new product development, feature enhancements, and service offering improvements.

-

Product Lifecycle Management (PLM) Integration: Feeding aftermarket data back into engineering and product design processes to improve product reliability, reduce warranty costs, and design for serviceability and remanufacturing from the outset.

-

Competitive Intelligence: Analyzing service trends and common failure points to identify market gaps and gain insights into competitor product performance and service strategies.

Aftermarket as the Future of Industrial Value

The imperative is clear: the aftermarket is no longer a secondary consideration but a core pillar of sustainable growth and profitability for European industrial companies. Those who proactively invest in an integrated digital ecosystem, pivot to outcome-based models, optimize their parts supply chains, nurture a value-driven service culture, and leverage aftermarket data for strategic insights will forge an unassailable competitive advantage.

The shift requires leadership commitment, cross-functional collaboration, and a willingness to challenge long-held organizational assumptions. The companies that embrace this transformation will not only secure resilient revenue streams but also deepen customer relationships, enhance brand loyalty, and future-proof their enterprises against an increasingly competitive landscape. The time to act is now.

Unlocking the full potential of your aftermarket operations is a complex journey, but one with significant returns. If your organization is ready to redefine its service strategy and drive exponential value, get in touch. We can help you navigate this transformation.

——————————————————————————————————————————-

ABOUT REV PARTNERS

REV Partners. Business Transformation Experts. Digital Transformation Experts. We are a Management Consulting & Advisory firm. We help Fortune 500 & Private Equity clients address the most pressing issues related to Transformation, Strategy, Operations, Organization and Digital. We can also provide experienced experts as Interim “Chief Transformation Officer” or equivalent, to accelerate, lead and execute ambitious Business Transformation or Digital Transformation programs. If you or your organization need support, please contact us, follow us on Twitter, or Email us at meet@revpartners.com.

© REV Partners. All Rights Reserved.